Selling Mineral Rights for Maximum Value in 2026

Do you want to know how to sell mineral rights? Our guide will help you understand the process of selling mineral rights from start to finish.

At US Mineral Exchange we are focused on helping mineral owners sell mineral rights for maximum value. If you’ve been looking for the definitive guide to sell mineral rights, this is it!

FREE GUIDE

Download our free mineral rights guide now! Learn more about your mineral rights.

Garrett Phelan

CEO of US Mineral Exchange with over 27 years of experience in the oil and gas industry. For nearly two decades, he has helped individuals, families, trusts, and non-profits navigate the complexities of mineral and royalty rights to achieve the highest sale prices.

Widely recognized as an industry expert, with an unwavering commitment to a client-first philosophy and extensive industry knowledge, he has been featured in Hart Energy, Yahoo Finance, and the Permian Basin Petroleum Association magazine.

Why Sell Mineral Rights

Before selling mineral rights, it’s important to step back and evaluate your financial goals. For some high-net-worth individuals, holding mineral rights long-term can make sense. But in most cases, selling mineral rights is the smarter financial move—especially in 2026’s volatile energy landscape.

Why Selling Mineral Rights Is Often the Best Financial Decision

Below are the top reasons why many mineral owners choose to sell:

1. Tax Advantages—Selling mineral rights can significantly reduce your tax burden.

Royalty payments are taxed as ordinary income, while proceeds from selling mineral rights are treated as capital gains. This distinction can significantly affect your total tax liability—especially if you have other sources of income.

Royalty income can push you into a higher tax bracket, increasing your overall tax burden. By contrast, selling mineral rights is taxed at lower long-term capital gains rates, which may result in substantial tax savings.

For those who inherited mineral rights, a stepped-up basis makes selling even more tax-efficient. Understanding these tax differences is essential when deciding whether to hold or sell.

2. Diversification of Wealth—Don’t keep all your net worth in one volatile asset.

Many mineral owners have a large portion of their wealth tied to a single, unpredictable asset. If your mineral rights make up more than 10% of your net worth, you should strongly consider selling and reinvesting.

Proceeds from a sale can be moved into diversified investments like a total stock market ETF offering stability and quarterly dividends..

3. Lack of Control Over Your Asset— Unlike stocks or real estate, you have no control over how your mineral rights are developed.

When you own stocks or property, you make the decisions. With mineral rights, you’re at the mercy of the oil and gas operator. You don’t control if, when, or how your minerals are developed. Many mineral owners wait years—sometimes decades—without any drilling activity.

Even if you’re currently receiving royalties, you have no say in whether new wells are drilled, or whether existing wells are shut-in or permanently abandoned. Your income can stop overnight with no warning, leaving you with an asset that produces nothing.

Selling your mineral rights eliminates this uncertainty and gives you a guaranteed payout based on today’s value.

4. Volatility of Oil & Gas Prices—Royalty income is unpredictable and tied to market swings.

Oil and natural gas prices fluctuate dramatically. Even if drilling occurs, your royalty checks can vary wildly from month to month. Selling mineral rights removes this risk and locks in value based on today’s market.

5. Meet Short-Term Financial Goals—Use your asset to fund major life expenses.

Selling mineral rights can provide immediate cash for:

- Paying off debt

- Starting a business

- Making a home down payment

- Covering college tuition or wedding costs

- Funding your retirement

Rather than waiting years to collect royalties, you can put that money to work now.

6. Medicaid Eligibility Concerns—Royalty income may disqualify you from Medicaid.

In many states, oil and gas income can count against Medicaid eligibility. The rules are complex, but selling your mineral rights may be the right strategy to qualify. We offer a detailed guide to help you evaluate this option.

Bottom Line: Selling Mineral Rights in 2026 Can Maximize Your Value

In today’s uncertain energy market, selling mineral rights gives you immediate liquidity, tax savings, and the ability to diversify your wealth. Whether you’re planning for college, retirement, or a short-term financial need, now may be the best time to sell.

Get Expert Guidance on Your Specific Situation

Every mineral owner’s situation is unique.

Fill out our free consultation form to speak with an expert and find out if selling your mineral rights is the best move for you in 2026.

No pressure. No obligation. Just honest answers.

How to Maximize Value When Selling Mineral Rights

If you want to get the highest possible price for your mineral rights, competition is critical. The more

buyers you reach, the more likely you are to receive top dollar.

Why Selling on Your Own Often Backfires

Many mineral owners attempt to sell on their own—reaching out to a few buyers and accepting what seems like a fair offer. But here’s the problem:

You simply can’t reach enough buyers on your own to discover the highest price possible.

Every buyer evaluates mineral rights differently based on factors like production history, location, operator, and pricing models. If you only speak to a handful of buyers, you’ll never know how high the offers could have gone.

Example: A Missed Opportunity

Let’s say you contact a few buyers and get an offer of $4,000 per acre. It’s the highest offer you received, so you assume it’s fair market value.

But in reality, you have missed out on a much better deal. By listing through US Mineral Exchange,it’s possible you could’ve received $5,800 per acre or more—simply because more buyers saw your listing and competed for it as in the example below.

The Power of Competition

It is extremely rare that there is not a higher offer out there—often significantly higher. The key to unlocking that value is putting your minerals in front of thousands of buyers at once. When buyers compete, the price goes up.

That’s exactly what we do at US Mineral Exchange. When you list at US Mineral Exchange, our expert teams directly markets your mineral and royalty rights to a very large network of vetted buyers so you can sell with confidence and maximize the value of your mineral rights—a network we have built since 2012.

Selling without competition almost always means leaving money on the table.

If you’re serious about maximizing value, the first step is exposure to the right audience—and we deliver exactly that.

Who Buys Mineral Rights?

Who Buys Mineral Rights?

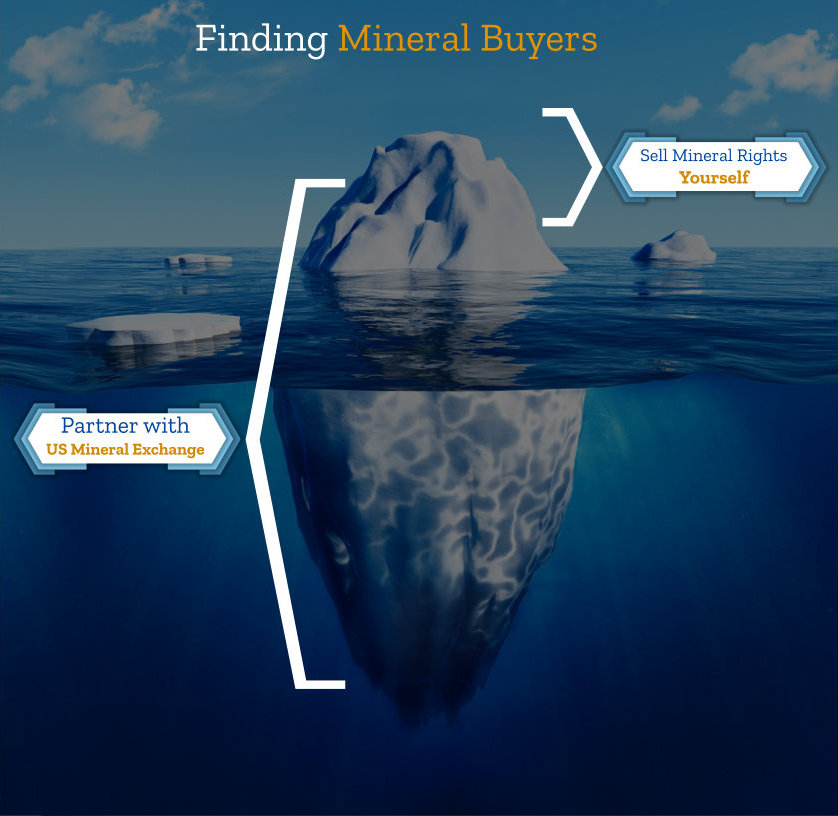

Finding mineral buyers isn’t difficult—there are thousands of them across the country. A quick Google search will turn up names of individuals, private companies, public corporations, and investment groups that at least claim to buy mineral rights.

The Real Challenge: Finding the Right Buyer

The hard part isn’t finding a buyer—it’s finding a legitimate buyer who will pay the highest price.

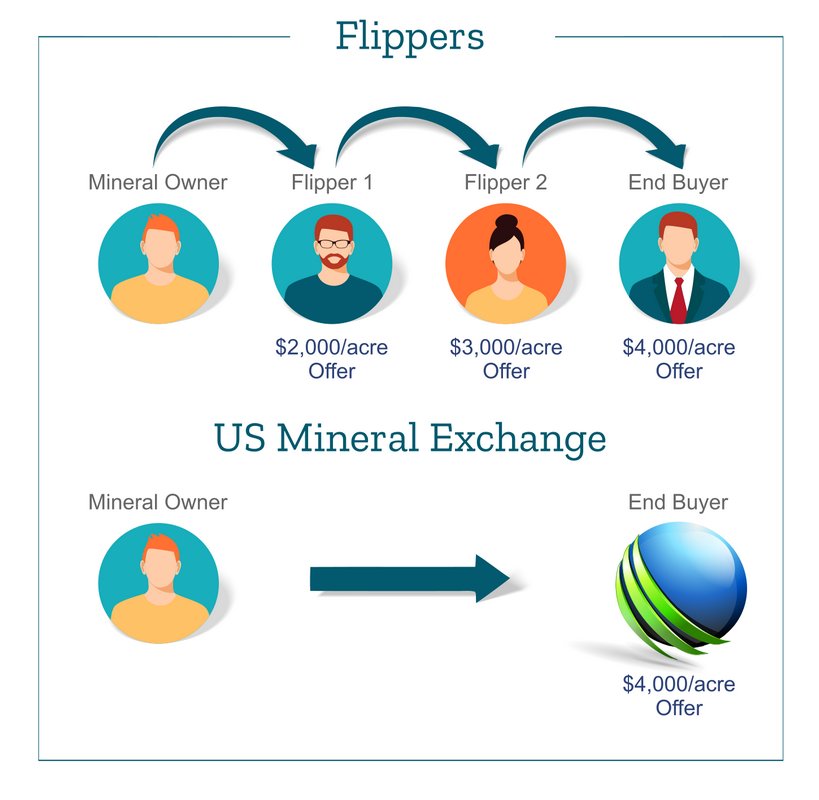

Many so-called “buyers” aren’t really buyers at all. They’ll make you an offer, get you under contract, and then flip that contract to a real buyer for a profit. These middlemen rarely disclose their intentions, and figuring out who actually buys versus who flips is nearly impossible for most mineral owners.

Even if you find a legitimate buyer, it’s unlikely they’re offering top dollar. Most mineral owners talk to just a few buyers, accept what sounds like a fair offer, and unknowingly sell below market value—often leaving thousands, if not hundreds of thousands, on the table.

You Need an Advocate

This is why it’s critical to have someone on your side who knows the industry.

At US Mineral Exchange, we help you avoid flippers, filter out lowball offers, and connect you directly with serious, qualified buyers—so you can sell your mineral rights for the absolute highest value.

Common Mistakes to Avoid When Selling Mineral Rights

Over the years, we’ve seen mineral owners make costly mistakes that could have been avoided with the right guidance. If you’re planning to sell, make sure to avoid these common pitfalls:

Selling For Sale By Owner: The biggest mistake you can make is trying to sell mineral or royalty rights on your own. Without expert guidance, you’re risking leaving money on the table and making costly errors at closing.

You’re also assuming you can find the best buyer and navigate a complex process filled with legal and financial traps. At US Mineral Exchange, we’ve spent decades learning the strategies and tactics used and we know how to protect your interests and maximize your value.

Accepting the First Offer: The most common mistake? Taking the first offer you receive. Many mineral and royalty owners feel pressure from deadlines or fear they won’t get another opportunity.

Don’t fall for urgency tactics. You or your family have likely held your mineral rights for years—don’t throw away their value by rushing into the first deal that comes along. The first offer is rarely even close to the best offer.Flippers: Flipping is rampant in the mineral rights industry. These “buyers” put you under contract at a low price, then sell your contract to someone else—often within days at a much higher price. And you won’t even know it is happening.

Here’s how it usually works:

- You accept an offer for $2,000/acre

- That buyer flips the deal to someone else for $3,000/acre

- That buyer then sells again at $4,000/acre

Meanwhile, you’re stuck with the lowest price, thinking you made a good deal.

Market Value: Many mineral owners overestimate the value of their mineral rights. We frequently hear statements like, “Oil prices will go up eventually,” or “Once they drill a few more wells, this will be worth a lot more.”

But here’s the truth: Your mineral rights are only worth what a buyer is willing to pay today—based on current market conditions and their expectations for future potential. While future drilling or rising oil or natural gas prices may improve value over time, those outcomes are uncertain and could take years.

If you’re looking to sell for the highest price possible—factoring in both current value and long-term potential—US Mineral Exchange can help you make that happen.

How to Sell Mineral Rights

When deciding how to sell your mineral rights, you have two main options:

1. Sell on Your Own

You can try contacting buyers directly, negotiating terms, and handling the legal and closing process yourself. While this may seem straightforward, it often results in lower offers, exposure to flippers, and a higher risk of costly mistakes.

2. Work with US Mineral Exchange

At US Mineral Exchange, we make the process simple, secure, and competitive. We market your interests thousands of verified buyers, help you navigate the closing process, and ensure you receive true market value for your mineral rights.

Selling mineral rights is a major financial decision—make sure you do it right.

Reasons to avoid selling mineral rights on your own:

Your Time: You could spend hours just trying to find a few buyers and submitting your information—with no guarantee of a fair offer.

Exposure: Even after hours of searching, you’ll only scratch the surface—there are thousands of buyers, and reaching them individually is impossible.

Flippers: You’ll have to watch out for flippers—middlemen who rush you to sign, then profit by reselling your deal at a much higher price.

Shady Buyers: Not all buyers are created equal. Some will take advantage of a mineral owner’s lack of experience to secure deals far below market value.

Negotiation: Unless you’re highly experienced, negotiating the best possible deal when selling mineral rights can be extremely difficult.

Final Sale: In the end, you’ll have no way of knowing if you got maximum value. Were there other buyers who would have paid more? Very often, the answer is yes.

Reasons to list with US Mineral Exchange:

Save Time: Provide your information once and gain instant access to a vast network of buyers—no need to spend time searching on your own.

Maximize Value: Your property will get instant exposure to a vast network of buyers who compete against each other—driving up the price and maximizing the value of your mineral rights.

Quality Buyers: No need to worry about flippers or shady offers—you’ll work with industry experts who understand the market and connect you with serious, qualified buyers.

Tough Negotiators: Working with industry experts gives you the upper hand. Buyers know they’re competing, so they negotiate more aggressively—helping you secure the best deal.

Final Sale: When you close the sale, you’ll have full confidence knowing an expert was by your side, protecting your interests and helping you maximize your mineral rights’ value.

Selling mineral rights on your own often means wasted time, added stress, and less money. You must navigate a complex process—finding a trustworthy buyer who won’t take advantage and who will pay the highest price.

Working with an expert who specializes in mineral rights sales is essential to protect your interests and maximize your value.

Where to Sell Mineral and Royalty Rights

Attorneys: While attorneys can help with legal paperwork, they rarely get you the best price. Their buyer networks are limited, often resulting in below-market sales.

Cold Calls: Some companies still cold call mineral owners to pressure them into quick sales. You only talk to one buyer this way — no competition means you likely leave money on the table.

Knock at the Door: Though rare, door-to-door buyers use high-pressure tactics and will pay less than fair value. Avoid selling your mineral rights this way.

Letters in the Mail: Many mineral owners receive frequent letters in the mail from companies offering to buy their mineral rights. While these mailers may seem like convenient offers, it’s important to understand that the highest-paying buyers rarely use this method to find sellers. Instead, major buyers rely on our company to locate quality mineral rights listings.

Accepting offers based solely on these letters means you’re missing out on access to a much larger pool of serious buyers who can pay significantly more. Often, these mail offers come from companies or flippers who aim to secure contracts below market value and then resell at a profit. Choosing to sell based only on mail offers could result in selling your mineral rights for far less than their true worth.

Online Mineral Buyers: Submitting your information to random websites is risky. You can’t be sure who’s behind them — some may be legitimate buyers, others are flippers or worse. This approach is like throwing darts blindfolded.

US Mineral Exchange: The best way to sell mineral rights is through US Mineral Exchange. Submit your info once, and we expose your property to thousands of verified buyers. We negotiate on your behalf and guide you through the entire closing process.

Already have an offer? No problem — we only get paid if we secure you a higher price. Listing with us is risk-free and ensures you get the best market value for your mineral rights.

Selling Mineral Rights at US Mineral Exchange

Already have an offer to sell your mineral rights? No problem. At US Mineral Exchange, we operate on a performance-based model — we only get paid if we secure a higher price for you. This means listing your mineral rights with us is completely risk-free.

By partnering with US Mineral Exchange, you gain access to our extensive network of thousands of serious, verified buyers competing for your property. This competitive environment drives up the price, ensuring you receive the best possible market value for your mineral rights.

We also facilitate the entire closing process to make sure there are no surprises at closing, guiding you every step of the way. Our goal is to provide a smooth, transparent experience from listing to final sale, with zero costs to you.

We encourage you to learn more about how the process works and the required documents to list.

Don’t settle for less — let us help you maximize your return with confidence and peace of mind.

Contact US Mineral Exchange:

If you have questions about how to sell your mineral rights, we’re here to help! We talk with mineral owners every day and look forward to assisting you. Please don’t hesitate to fill out the form below with any questions—our friendly team will respond promptly.

Popular Content

- Sell Mineral Rights

- Mineral Rights Value

- Calculate Value

- Market Value

- Mineral Rights Buyers

- Mineral Rights Appraisal

- Mineral Rights Brokers

- Should you Sell Mineral Rights

- Never Sell Mineral Rights

- 10 Helpful Tips

- Mineral Interest Types Explained

- Common Mistakes

- Mineral Rights & Taxes

- Medicaid & Mineral Rights

- Common Q&A

Free Consultation

Free Consultation

Common Questions

The more information you can provide about your property the better! We can give you a better idea about the value of selling mineral rights if you provide more information. The most important thing we need is for you to answer the questions and provide your state and county.

If you have the required documents to list, providing those is extremely helpful!

Absolutely not! When you inquire at US Mineral Exchange we will not be putting any pressure on you to sell. We will help answer any questions you have whether you are interested in selling or not.

At US Mineral Exchange, we take privacy very seriously. We will NEVER sell your information or use it without your consent. When you send us documentation or tell us about your property, that information does not go outside our company without your consent. Even when you list a property for sale on our website, we strictly control who has access to the information about your listing so that only legitimate buyers will be able to see property details.

Many mineral owners make the mistake of getting an offer and quickly selling. They then accept an offer far below market value because they felt pressure to sell. There is nearly always a better price available.

Imagine you were selling a home. Would you get the best price from a random person who walks up and makes you an offer? No way! Now imagine you list the home on the MLS where thousands of potential buyers know your house is for sale. The key to getting the best price is competition. Our guide to selling mineral rights explains everything.

The reason that so many mineral owners decide to sell mineral rights at US Mineral Exchange is access to our large network of mineral rights buyers. Our goal is to help you get top dollar for selling mineral rights by getting your property in front of a huge audience of buyers. This allows buyers to compete against one another which ensures you get fair market value for selling mineral rights.

There are absolutely no cost to list your property. When you locate a buyer by listing your property with us, we are paid a commission directly by the buyers closing agent. This means you never have any out of pocket expenses ever. We only get paid if we can get you a better price than the current offer you have in hand.

FREE GUIDE

Download our free mineral rights guide now! Learn more about your mineral rights.